Table of Contents

- Configurations For 2025 Land Rover Range Rover - Ray Leisha

- Rice Football Record 2025 - Gabbi Kristen

- 2024 Grammys Channel 6 - Edee Nertie

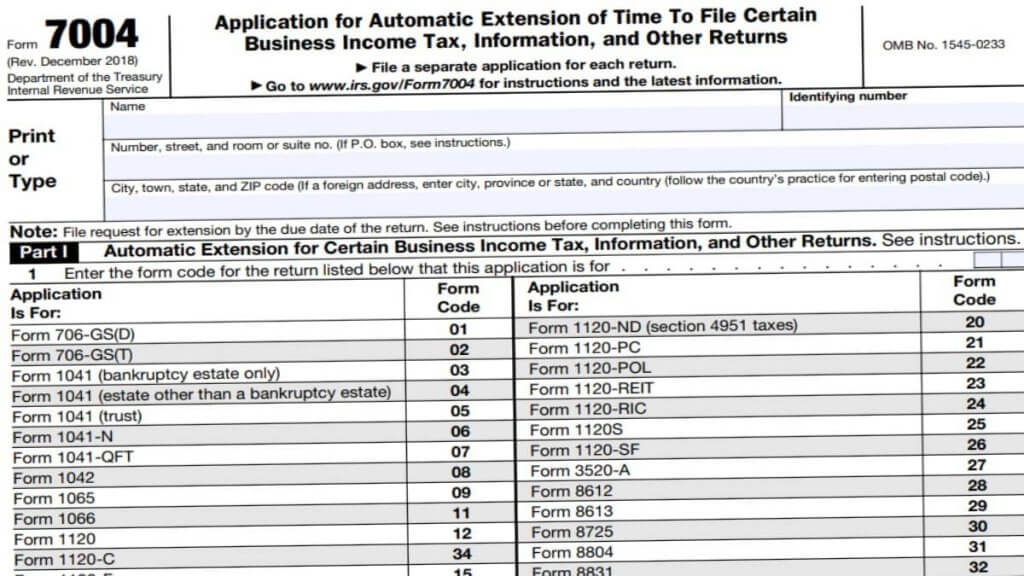

- Tax Deadline 2024 Extension Form 2024 - Meade Jocelyn

- 2024 Grammys Channel 6 - Edee Nertie

- Income Tax Calculator | EE Tax 2025

- Efficient Tax Preparation With H&R Block Checklist Excel Template And ...

- 2025 Estate Tax Exemption | Mariner

- Tax Preparation - Livable Solutions

- Efficient Tax Preparation With H&R Block Checklist Excel Template And ...

Understanding the Importance of Tax Documents

Personal Identification Documents

- Social Security number or Individual Taxpayer Identification Number (ITIN)

- Driver's license or state ID

- Passport (if applicable)

Income-Related Documents

Next, collect all the documents related to your income:- W-2 forms from your employer(s)

- 1099 forms for freelance work, investments, or other sources of income

- Interest statements from banks and investments (1099-INT)

- Dividend statements (1099-DIV)

- Capital gains statements (1099-B)

Deduction-Related Documents

To maximize your deductions, gather the following documents:- Charitable donation receipts

- Medical expense receipts

- Mortgage interest statements (1098)

- Property tax statements

- Business expense records (if self-employed)

Dependent-Related Documents

If you have dependents, collect the following documents:- Birth certificates or adoption papers

- Social Security numbers or ITINs for dependents

- Child care expense receipts

- Education expense receipts

By following this checklist, you'll be able to ensure that you have all the necessary documents to file your taxes correctly and avoid any potential delays or penalties. Stay ahead of the game and get ready for tax season with our essential guide to tax documents.

Note: The article is written in HTML format with headings, subheadings, and bullet points to make it SEO-friendly and easy to read. The word count is approximately 500 words.